Of the Income Tax Act 1967 ITA. Get to know the latest updates by downloading a copy of the Tax Espresso newsletter on the right.

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

This post outlines 7 influential tax cases in 2020.

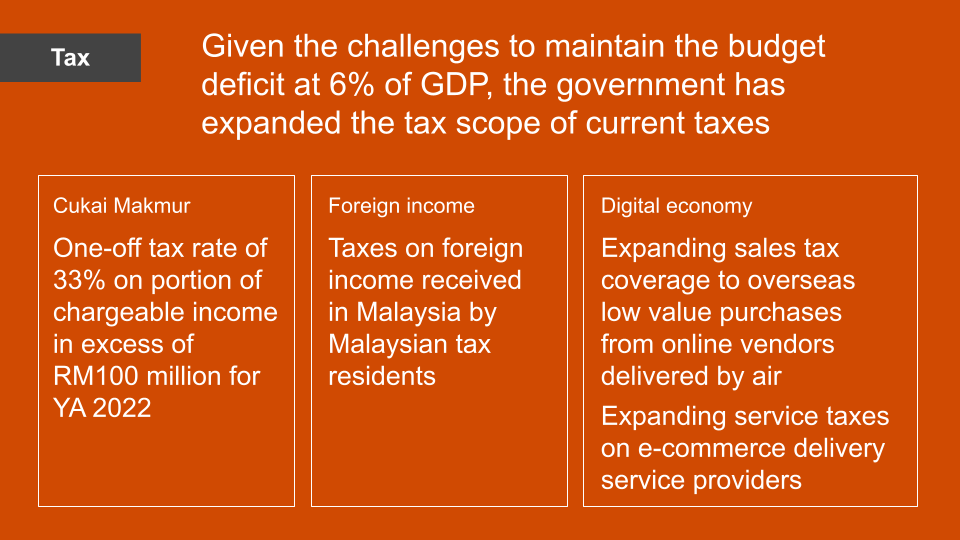

. Effective Jan 1 2022 a proposal to remove tax exemption on income derived from foreign sources and received in Malaysia by Malaysian residents under Paragraph 28 Schedule 6 of the Income Tax Act ITA 1967 was announced in the recent Budget 2022. On 6 November 2020 Malaysias minister of finance announced the 2021 national budget. Expat employees who work in Malaysia for more than 182 days are classed as residents - they must pay income tax at the progressive rates set by the Malaysian government.

View CURRENT ISSUES IN TAXATION SLIDEpdf from TAX 667 at Universiti Teknologi Mara. With that being said there are a few noteworthy tax cases that laid down important principles and applications of the law. Place of exercise of control and management.

Following the recently concluded Special Voluntary Disclosure Program SVDP in September 2019 the IRB will increase its staff allocation for its enforcement activities from 60 to 80 in 2020. Sales Tax and Service Tax SST came into effect in Malaysia on 1 September 2018. These unintended and unplanned presence and absence have given rise to tax issues as follows.

Malaysian tax enforcement in 2020 - Updates. Place of exercise of employment. 1341 Sales Tax 13411 Effective date and scope of taxation Sales tax is a single-stage tax imposed on taxable goods manufactured locally by a registered manufacturer and on taxable goods imported by any person.

Review of income tax rate for individuals. Whilst income derived from the branch in Malaysia is liable to tax in Malaysia. KUALA LUMPUR Nov 16.

This is in line with its focus on tackling the issue of missing revenue from the shadow economy. It is indeed an honour to have been invited to this national seminar on taxation to present my thought to such distinguished and prominent audienceI wish to record my sincere gratitude to the organizing committee for choosing me to present the theme paper of this seminar on Challenges in the Tax System. 1 There is also an increase an extension and an expansion of the scope of tax reliefs this includes the.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Under this provision a company director during the period in which that tax is liable to be paid by the company can be made personally liable for such taxes provided that he holds directly or indirectly more than 20 of the companys shares. This is the largest ever state budget worth some 3332 billion ringgit US802 billion as the government aims to boost post-pandemic growth.

Malaysia and the United States had on 30 June 2014 reached an agreement in substance on a Model 1 IGA to implement the Foreign Account Tax Compliance Act FATCA. Accounting By 3E Accounting Services Sdn. MASB Publishes New Classification Notice for Liabilities to Ensure Consistency New Amendments Will Clarify Debts and Liabilities as Current or Non-current As of 16 March 2020 the Malaysian Accounting Standards Board MASB has published a new notice which will better classify debts.

Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. The purpose of this move is to gain higher tax revenues. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

Under the IGA reporting Malaysia-based financial institutions will provide the Malaysian Inland Revenue Board with the required. What is the change. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Further large MNEs will be subject to a minimum 15 global minimum tax rate from 2023. A key development emerging from the G7 Finance Ministers meeting which took place on 5 th June 2021 was a communiqué centred on principal design elements for international tax reform for the Organisation for Economic Co-operation Developments OECD countries Macdonald et al 2021. Tax residence in Malaysia.

Below are the relevant issues from the individual tax as well as an employers and employees perspectives. 94 Issues of Double Taxation and Tax Treaties Where income from e-commerce by a resident person is subject to tax both in Malaysia and the foreign country provision for relief is available in the relevant Double Taxation Agreement DTA entered into by the. Malaysias Minister of Finance MOF presented the 2021 Budget proposals on 6 November 2020 announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000.

The challenge to me rather is how to lift up to the expectation of the. Updates on Double Tax Agreements. IBM Malaysia Sdn Bhd v KPHDN.

Deloitte Malaysia is recognised as Malaysia Tax Firm of the Year 2021 and Transfer Pricing Firm of the Year 2021 by the International Tax Review. Currently individuals who are tax residents with a chargeable income. Further this is the first budget under the administration of.

In our book Spotlight on Current Malaysian Tax Issues we. Expat employees who work in Malaysia for more than 60 days but less than 182 days are classed as non-residents - and must pay income tax at a flat rate of 30. This case concerns the legal status of an advance ruling under Section 138B of the Income Tax Act 1967 the Act.

The IGA was formally signed on 21 July 2021. Compliance with International Best PracticeThe Proposal to abolish the. That said income of any person other than a resident.

All income accrued in derived from or remitted to Malaysia is liable to tax. Income that is attributable to a place of business as defined in Malaysia is also deemed derived from Malaysia. On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022.

Increase in minimum wage effective 1 May 2022. Creation of a permanent establishment PE for an enterprise or entity. Under Pillar One a portion of profits derived by an MNE with global turnover exceeding 20bil RM97bil.

Since Malaysia income tax rate is relatively higher IRBM wants to ensure that TP is not arbitrary and no loss of revenues for. Like many other jurisdictions Malaysia has its own taxation system. TAX667 ADVANCED TAXATION Chapter 9 CURRENT ISSUES IN TAXATION Learning Outcomes At the end of this chapter Study Resources.

Malaysian Households During Covid 19 Fading Resilience Rising Vulnerability

What Tax Offences Should You Avoid In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Exclusive Malaysia May Cut Palm Oil Export Tax By Half Amid Global Supply Crisis Reuters

How To Create A Free Payslip Template In Excel Pdf Word Format How To Wiki Payroll Template Receipt Template Templates

Gst In Malaysia Overcoming Adversity Throw In The Towel Frugal

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Malaysia Sst Sales And Service Tax A Complete Guide

Tax Implications On Digital Services Crowe Malaysia Plt

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Payroll And Tax Activpayroll

Sales Service Tax Sst In Malaysia Acclime Malaysia

Contoh Resume Student Uitm Resume Template Resume Job Resume Template

Individual Income Tax In Malaysia For Expatriates

Pedro Da Costa On Twitter Tax Haven Offshore Bank Developing Country

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)